Pre-Market Analysis for 8th Nov’2024

I. Overall Market Sentiment

*Data collected from NSE website.

Key Indicators driving the Market Sentiment:

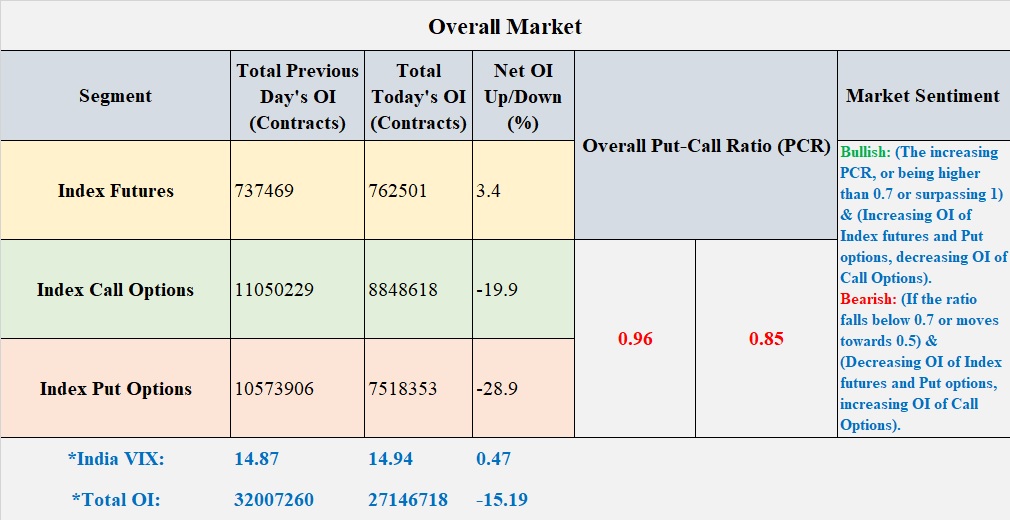

1. Open Interest (OI) Changes

Overall OI declined by 15.19%, suggesting reduced market participation, likely due to caution ahead of key economic events.

2. Volatility Indicator (India VIX)

The volatility index increased slightly by 0.47%, pointing to a slight uptick in market nervousness.

3. Segment-wise OI Changes

Index Futures saw a 3.4% increase, possibly hinting at directional trading interest.

Index Call Options and Index Put Options saw significant drops (-19.9% and -28.9%, respectively), indicating cautious or reduced hedging activities.

4. Overall Put-Call Ratio (PCR)

The overall PCR dropped from 0.96 to 0.85, suggesting a cautious to bearish bias.

*For detailed analysis, please subscribe@ https://www.youtube.com/@KRVFinMart

II. Institutional Activity Analysis

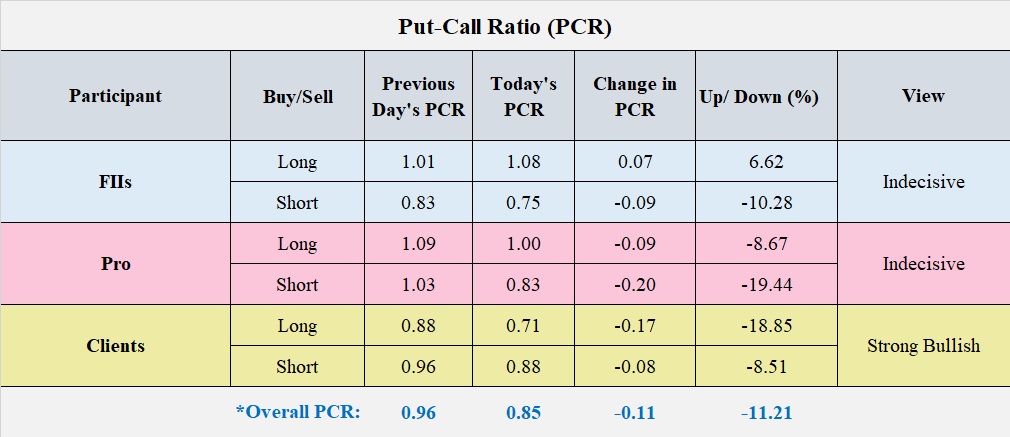

1. Foreign Institutional Investors (FIIs)

Key Points & Observations:

1. Index Futures: FIIs increased their long and short positions, with short positions seeing a significant rise (+8.0%) to 33.8%, indicating a potential bearish bias in the futures segment.

2. Index Call Options: Both long and short call positions declined notably, with long positions dropping by 32.5% and short positions by 24.3%. This reduction shows a diminishing call option interest, possibly reflecting cautious sentiment.

3. Index Put Options: FIIs reduced both long and short put positions significantly, with long positions down by 28.0% and short positions by 32.1%. This drop in put interest suggests lower hedging activity.

4. Put-Call Ratio (PCR): The PCR for long positions increased to 1.08, indicating a slight shift toward bullish sentiment in long positions, while the PCR for short positions decreased to 0.75, reinforcing a bearish inclination.

2. Proprietary Traders (Pro)

Key Points & Observations:

1. Index Futures: Pro traders reduced long positions by 5.9% while increasing shorts by 4.6%, suggesting a negative outlook on the futures side.

2. Index Call Options: Both long and short call options saw declines, with long positions down by 6.3% and short positions down by 9.5%. The decline in call participation signals cautiousness in call option positioning.

3. Index Put Options: Long and short put positions dropped significantly by 14.5% and 27.1%, respectively, indicating decreased activity on both sides.

4. Put-Call Ratio (PCR): Both the long and short PCR decreased, with the long PCR moving to 1.00 and the short PCR dropping to 0.83. This balanced stance reflects an ambivalent sentiment among proprietary traders.

3. Clients (Retail & HNI Traders)

Key Points & Observations:

1. Index Futures: Retail and HNI traders increased their long positions by 6.0%, raising the total to a substantial 64.0%, while short positions saw a minor uptick. This strong long bias in futures suggests optimism.

2. Index Call Options: Both long and short positions saw significant drops, with long positions falling by 19.4% and short positions by 22.3%, reflecting reduced activity in call options.

3. Index Put Options: There were large declines in both long and short put positions, with longs down 34.6% and shorts down 28.9%, indicating reduced demand for puts.

4. Put-Call Ratio (PCR): The PCR for longs decreased to 0.71, while the short PCR decreased to 0.88, suggesting a slightly more cautious stance from clients.

4. Domestic Institutional Investors (DIIs)

Key Points & Observations:

1. Index Futures: DIIs maintained a stable long position at 18.4%, with a slight reduction in shorts by 0.3%, showing minimal change in their outlook.

2. Index Call Options: DIIs showed no activity in call options, which is typical given their generally conservative trading approach.

3. Index Put Options: There was a modest decrease of 5.5% in long put positions, bringing the total to 2.3%, indicating a minor reduction in hedging activity.

III. Conclusion: Market Outlook for the Day

The data indicates a mixed but cautious sentiment with an underlying bearish tone, primarily driven by FIIs increasing shorts in index futures and a decline in both call and put option activity across participants. The rise in India VIX, along with the reduction in OI, implies increased caution among market participants. For today, this overall setup suggests a slightly bearish bias, with potential resistance on rallies due to a high level of short interest from FIIs and proprietary traders.

*For the concepts, please enroll @ https://krvfinmart.com/courses

*Disclaimer: The content provided on KRVFinMart is intended for educational and informational purposes only. We are not licensed financial advisors, investment professionals, or legal experts. By accessing and using our content, you acknowledge that you have read and understood this disclaimer. You agree that KRVFinMart is not liable for any direct or indirect consequences, losses, or damages resulting from your reliance on the information provided on this website/Channel. (*For any other info, contact us @ https://krvfinmart.com/contact-us).

Responses